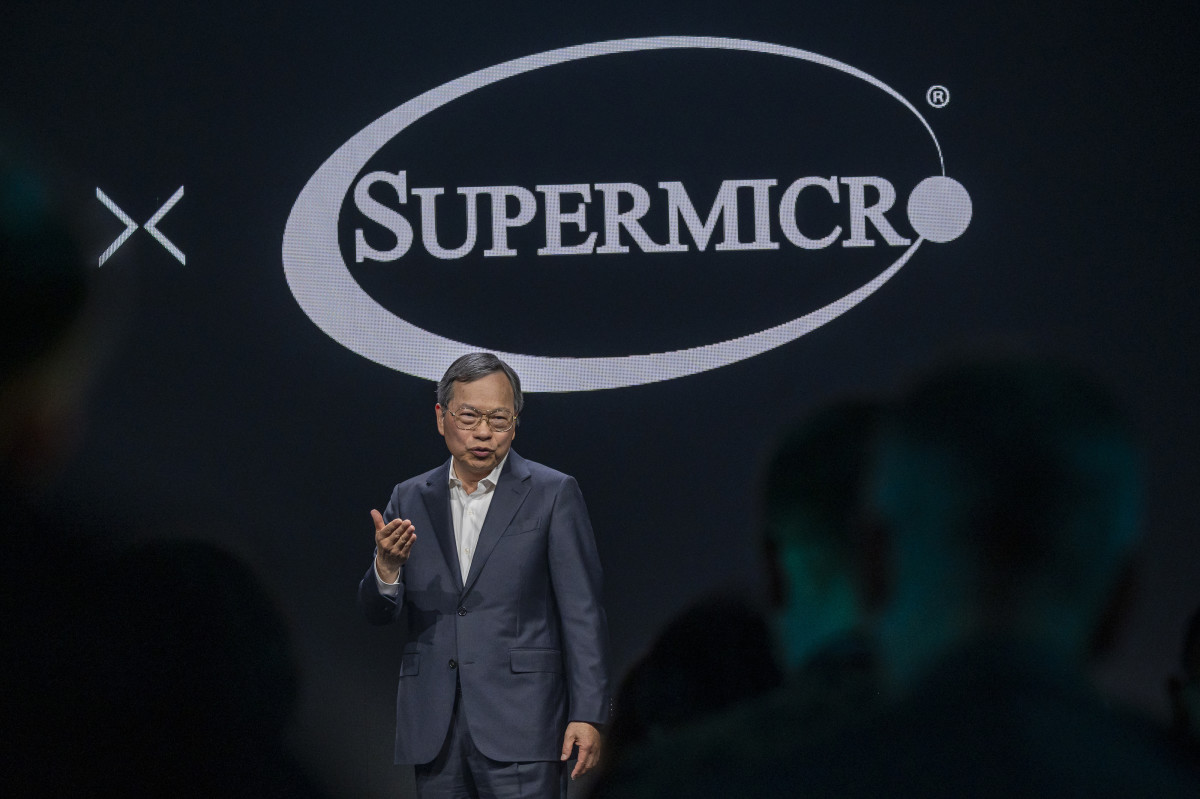

Why Analysts Love Super Micro Computer’s Shares!

Why Analysts Love Super Micro Computer's Shares!

In a world where technology evolves at lightning speed, one company is quietly revolutionizing the landscape of high-performance computing—Super Micro Computer.

With its innovative solutions and strategic foresight, this tech powerhouse has caught the eye of analysts eager to uncover the next big investment opportunity.

But what exactly makes Super Micro’s shares so irresistible? Join us as we dive into the secrets behind their soaring popularity, explore market trends that are fueling excitement, and reveal why savvy investors are racing to get on board.

Whether you’re a seasoned investor or just curious about tech stocks, this post will guide you through the compelling reasons why Super Micro is turning heads—and how it could transform your portfolio!

Introduction to Super Micro Computer

In the fast-paced world of technology, few companies manage to capture the attention of analysts quite like Super Micro Computer. As a leader in high-performance computing solutions, this innovative firm is making waves in an ever-evolving industry.

With advancements that cater to diverse sectors—from artificial intelligence to cloud computing—Super Micro Computer stands at the forefront of technological innovation.

But what exactly has analysts buzzing about its shares? Amidst fierce competition and rapid growth demands, Super Micro Computer’s stock performance provides intriguing insights into both its current standing and future potential.

Investors are keenly watching as this tech powerhouse not only adapts but thrives in today’s digital landscape. Let’s dive deeper into why so many eyes are on Super Micro Computer’s shares and what it means for potential investors looking for promising opportunities in the market!

Overview of the Technology Industry

The technology industry is a dynamic and ever-evolving landscape. It encompasses various sectors, including software, hardware, and telecommunications. Innovators are constantly pushing boundaries to create solutions that enhance productivity and connectivity.

Emerging technologies like artificial intelligence and cloud computing have transformed how businesses operate. Companies are adopting these advancements to streamline processes and improve efficiency.

Additionally, the demand for data management has skyrocketed. With more enterprises shifting to digital platforms, the need for robust infrastructure grows exponentially. This trend fuels investments in data centers and related services.

Competition within this field is fierce. Market leaders strive to maintain their edge while new players emerge with disruptive ideas. Staying ahead requires agility and foresight as consumer preferences shift rapidly.

In this bustling environment, organizations must adapt quickly or risk falling behind in the race for innovation.

Reasons for Analysts' Interest in Super Micro Computer's Shares

Analysts are increasingly drawn to Super Micro Computer’s shares due to the company’s robust financial performance. Their consistent revenue growth and impressive profit margins have caught the eye of many investors.

Another key factor is their innovative technology. Super Micro Computer continually pushes boundaries, offering cutting-edge solutions that meet modern computing demands. This commitment to innovation positions them well in a rapidly evolving market.

The growing demand for data centers further amplifies interest in their stocks. As businesses shift towards cloud-based services, the need for efficient and scalable infrastructure becomes paramount. Super Micro Computer is poised to capitalize on this trend with its advanced offerings tailored for high-performance environments.

These elements combine to create a compelling narrative around Super Micro Computer’s potential, making it an attractive proposition for analysts looking for promising investment opportunities in the tech sector.

– Strong Financial Performance

Super Micro Computer has consistently demonstrated robust financial performance over recent quarters. This stability attracts the attention of analysts and investors alike.

The company’s revenue growth is impressive, often outpacing industry averages. Their strategic focus on high-demand sectors contributes to this upward trajectory.

Moreover, Super Micro’s strong profit margins are a testament to their efficient operations and cost management strategies. The ability to balance innovation with profitability is crucial in today’s competitive landscape.

Analysts also appreciate their solid cash flow position, which enables reinvestment into research and development. This proactive approach positions them well for future opportunities while maintaining shareholder value.

With a track record of meeting or exceeding earnings expectations, Super Micro Computer continues to build credibility in the eyes of market experts. As they navigate potential challenges ahead, their financial foundation remains an attractive aspect for those considering investment options in stocks related to technology.

– Innovative Technology

Super Micro Computer is at the forefront of technological innovation. Their commitment to developing cutting-edge solutions sets them apart in a crowded marketplace. With advanced server systems and software, they cater to diverse industries.

The company consistently invests in research and development. This focus enables Super Micro to stay ahead of trends, offering products that meet evolving customer needs. From energy-efficient servers to high-performance computing platforms, their offerings are robust.

Moreover, partnerships with leading tech firms amplify their capabilities. These collaborations enhance product functionality and expand market reach. Analysts frequently highlight this strategic approach as a key driver for future growth.

This innovative spirit not only attracts attention but also builds investor confidence. As companies seek reliable technology partners, Super Micro’s reputation for quality positions it favorably within the industry landscape.

– Growing Demand for Data Centers

The demand for data centers has surged dramatically in recent years. Businesses are increasingly turning to cloud computing solutions, driving the need for robust infrastructure.

As more companies transition to remote work and digital platforms, they require reliable storage and processing capabilities. This shift is not just a trend; it’s becoming essential.

Super Micro Computer stands at the forefront of this transformation. Their innovative technologies cater specifically to the needs of modern data centers.

With advancements in AI and machine learning, the appetite for high-performance computing continues to grow. Organizations want faster access to data, which means investing in cutting-edge hardware.

Green initiatives also play a role. Companies are looking for energy-efficient solutions that reduce their carbon footprint while maintaining performance levels.

This confluence of factors makes Super Micro Computer’s offerings particularly relevant now more than ever. The market is ripe with opportunity as businesses seek trusted partners in this evolving landscape.

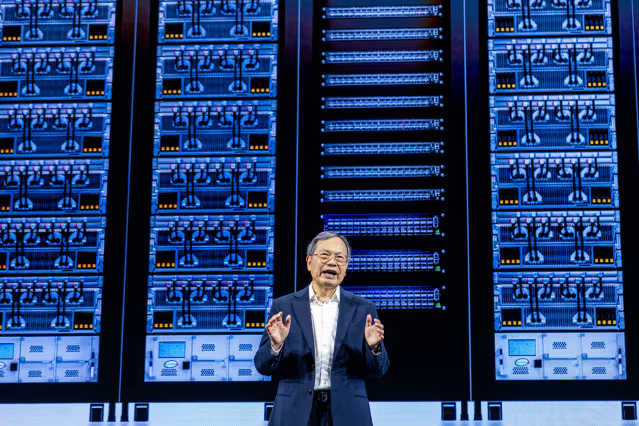

Detailed Analysis of Super Micro Computer's Business Model

Super Micro Computer operates with a robust business model focused on high-performance computing solutions. Their product offerings include servers, storage systems, and networking devices tailored for diverse industries.

One key component is their customization capability. Clients can select configurations that meet specific needs, driving customer satisfaction and loyalty. This adaptability sets Super Micro apart in the competitive tech landscape.

Their market reach extends globally. With operations across multiple continents, they cater to enterprises of all sizes—from startups to Fortune 500 companies—ensuring broad accessibility to their innovative technologies.

The company leverages strategic partnerships with key industry players like Intel and AMD. These alliances enhance their product development pipeline while ensuring access to cutting-edge technology trends.

By maintaining a strong focus on R&D, Super Micro continually innovates its offerings. This commitment not only strengthens its position but also aligns with the ever-evolving demands of the technology sector.

Product Offerings and Market Reach

Super Micro Computer boasts a diverse range of products that cater to various segments of the technology landscape. Their offerings include high-performance servers, storage solutions, and networking equipment designed for efficiency and scalability.

What sets Super Micro apart is its ability to customize solutions tailored to specific customer needs. This adaptability allows businesses to optimize their operations effectively.

With a global market reach, the company serves industries such as cloud computing, AI, big data analytics, and enterprise IT. Its strategic partnerships with major hyperscalers further enhance its visibility in international markets.

The focus on energy-efficient designs also resonates well with customers looking for sustainable tech options. By continually innovating and expanding its product line, Super Micro Computer positions itself favorably in an ever-evolving industry landscape.

Competitive Advantage in the Industry

Super Micro Computer has carved out a distinctive niche in the tech world. Its strong focus on customization allows it to meet unique client requirements effectively. This agility sets it apart from larger competitors who often follow a one-size-fits-all approach.

The company’s innovative product lineup enhances performance while keeping costs competitive. By leveraging cutting-edge technology, Super Micro consistently offers advanced solutions that attract discerning customers.

Moreover, its commitment to sustainability resonates well in today’s market. Clients appreciate eco-friendly practices and energy-efficient products, making Super Micro an attractive partner for forward-thinking organizations.

Strong supply chain management further bolsters its position in the industry. The ability to swiftly respond to market demands ensures they maintain relevance amidst rapid technological changes.

These factors culminate in a robust competitive advantage that keeps analysts optimistic about Super Micro’s future growth potential within the crowded tech landscape.

Discussion on Potential Risks and Challenges

Super Micro Computer operates in a dynamic environment, which presents certain risks. A significant concern is its dependence on a few key customers. Losing any of these major clients could adversely affect revenue streams and overall financial health.

Global economic conditions also play a crucial role. Economic downturns can lead to reduced IT spending. This directly impacts demand for Super Micro’s products and services.

Market volatility poses another challenge. Fluctuations in supply chain costs, particularly for components, can squeeze margins unexpectedly.

Additionally, competition is fierce within the technology sector. Rivals constantly innovate and adapt their strategies, potentially overshadowing Super Micro’s offerings if not addressed promptly.

Lastly, regulatory changes could create hurdles that necessitate rapid adjustments in operations or compliance measures. These factors make it essential for stakeholders to remain vigilant about potential impacts on the company’s stability and growth trajectory.

– Dependence on a Few Key Customers

Super Micro Computer thrives on a diverse customer base, but it has significant reliance on a handful of key clients. This dependence can pose risks that are worth noting.

When major customers account for a large portion of revenue, any shift in their purchasing behavior could impact financial stability. If they reduce orders or switch suppliers, Super Micro’s profitability could take a hit.

Moreover, negotiating power shifts to these larger clients. They may demand lower prices or more favorable terms, squeezing margins for Super Micro. This dynamic adds another layer of complexity to the business landscape.

Additionally, economic fluctuations affecting these key customers can ripple through Super Micro’s performance metrics. A downturn in sectors where key clients operate might hinder growth projections and stock performance.

Monitoring this dependency is crucial as analysts evaluate future potential and risk factors associated with investing in Super Micro Computer shares.

– Impact of Global Economic Conditions

Global economic conditions significantly influence Super Micro Computer’s performance. Fluctuations in the economy can affect technology spending by businesses. When times are tough, companies might tighten their budgets and delay investments in data centers.

Additionally, currency volatility plays a role. As a global player, Super Micro must navigate different currencies for international sales. A strong dollar could make its products more expensive overseas, potentially impacting revenue.

Supply chain disruptions also factor into the equation. Economic instability can lead to shortages of critical components needed for production. This situation may slow down manufacturing processes and impact delivery timelines.

Moreover, changing trade policies and tariffs create uncertainty for tech firms like Super Micro Computer. Navigating these complexities requires agility and strategic planning to mitigate risks effectively while seizing growth opportunities amidst challenges.

Outlook for Super Micro Computer's Future Growth

Super Micro Computer is poised for significant growth in the coming years. The company has ambitious expansion plans that include entering new markets and enhancing product offerings. By forging strategic partnerships, Super Micro aims to leverage synergies that can accelerate its reach.

The demand for advanced computing solutions continues to rise, driven by trends like cloud computing and artificial intelligence. This creates ample opportunities for the company to innovate and attract a broader customer base.

Analysts are optimistic about Super Micro’s financial performance as it positions itself within this expanding landscape. With a focus on research and development, the company is likely to introduce cutting-edge technologies that will not only meet but exceed market expectations.

Investors should watch closely as these initiatives unfold. The combination of strong leadership and a proactive approach may pave the way for remarkable success ahead.

– Expansion Plans and Partnerships

Super Micro Computer is on the move, embracing bold expansion plans that position it favorably in a competitive landscape. With strategic partnerships and collaborations, the company seeks to enhance its market presence significantly.

Recent alliances with leading technology firms have opened doors to innovative product development. These joint ventures enable Super Micro to leverage cutting-edge research and increase its portfolio of offerings. As demand for high-performance computing continues to surge, these partnerships become even more valuable.

Moreover, the company’s focus on international markets underscores its ambition. Expanding into regions such as Asia-Pacific not only diversifies its revenue streams but also taps into emerging industries eager for advanced solutions.

Investors should keep a keen eye on how these initiatives unfold. The trajectory of growth driven by collaboration could lead to substantial returns in shares over time.

– Forecasted Financial Performance

Super Micro Computer’s financial forecast paints an optimistic picture for investors. Analysts project consistent revenue growth, driven by robust demand in the technology sector.

The company’s strategic focus on innovation positions it well to capture market share. With advancements in high-performance computing and energy-efficient solutions, Super Micro is set to thrive.

Earnings per share are also expected to rise significantly over the next few years. This potential increase could attract more institutional investment, bolstering stock performance.

Moreover, ongoing partnerships with major tech firms enhance their credibility and expand their reach. As data center requirements surge globally, Super Micro’s business model aligns perfectly with emerging trends.

These factors collectively contribute to a positive outlook for Super Micro’s stocks. Investors keen on tapping into a growing market may find this company particularly appealing as they look ahead.

Comparison with Competitors in the Industry

Super Micro Computer stands out in a crowded marketplace filled with formidable competitors. Companies like Dell, HPE, and Lenovo present significant competition, each with their own strengths.

What sets Super Micro apart is its focus on high-performance computing solutions tailored for specific customer needs. While larger firms may offer broader product lines, Super Micro emphasizes customization and efficiency.

Additionally, the pricing strategy of Super Micro is often more competitive than that of bigger players. This allows them to capture market share while delivering exceptional value.

Their commitment to innovative technology also gives them an edge. With constant advancements in server architecture and energy-efficient designs, they remain at the forefront of industry trends.

This unique positioning helps analysts maintain a positive outlook on Super Micro’s growth potential as it navigates through competition effectively.

Why Investors Should Consider Investing in Super Micro Computer's

Super Micro Computer has been gaining traction among analysts and investors alike for several compelling reasons. Their strong financial performance speaks volumes about their stability in a fast-paced market. Coupled with innovative technology, Super Micro is at the forefront of developments that shape the future of computing.

The growing demand for data centers only adds to their appeal. As more businesses transition to cloud-based solutions, companies like Super Micro are positioned well to capture this expanding market. Their diverse product offerings and extensive market reach further illustrate their competitive edge.

However, potential investors should remain mindful of risks such as dependence on key customers and the unpredictable nature of global economic conditions. These factors could impact growth trajectories.

Looking ahead, Super Micro’s expansion plans and strategic partnerships indicate a robust outlook for future growth. Analysts forecast positive financial performance driven by increasing interest in scalable computing solutions.

With all these elements considered—financial health, technological innovation, and market positioning—investors may find Super Micro Computer’s shares worthy of serious consideration as they navigate investment opportunities in the tech sector.