Introduction to the Cash App Settlement

The world of digital finance is ever-evolving, and Cash App is no exception. As more users flock to this popular payment platform, significant changes are being made that could reshape your experience. With the recent Cash App settlement making headlines, many are wondering what it means for them moving forward.

Whether you’re a long-time user or just starting, understanding these updates can help you navigate your transactions with confidence. Let’s dive into what this settlement entails and how it could impact your everyday financial dealings on Cash App!

Background on the Lawsuit and Settlement

The Cash App settlement stems from a class-action lawsuit initiated by users who claimed the platform mishandled their personal information and failed to provide adequate protection.

Allegations included unauthorized transactions, insufficient customer service responses, and lack of transparency regarding fees. Users felt vulnerable when their financial data was exposed.

After lengthy negotiations, Cash App agreed to enhance security measures and implement better practices for user support. The settlement aims to address these grievances while restoring trust among its millions of users.

By taking this step, Cash App is signaling its commitment to improving user experience. It’s an effort not just for compliance but also to foster a more secure environment for digital transactions.

What is Included in the Settlement?

The Cash App settlement includes several significant components aimed at enhancing user experience. One of the most notable aspects is financial compensation for affected users. Individuals who experience issues related to unauthorized transactions may be eligible for restitution.

Another critical element involves improved customer service protocols. Cash App has committed to increasing response times and providing more accessible support channels, ensuring that user concerns are addressed promptly.

Additionally, there will be updates to the app’s privacy policy. This change aims to give users clearer insight into data usage and protection measures implemented by Cash App.

Lastly, educational resources will be made available within the app itself. These resources aim to empower users with knowledge about secure transaction practices and effective account management strategies, promoting a safer environment when using Cash App services.

Key Updates and Changes for Cash App Users

Cash App has rolled out significant updates aimed at enhancing user experience. One key change is the emphasis on increased transparency and communication. Users can now expect clearer information about fees, transactions, and service changes directly within the app.

Another noteworthy update involves enhanced security measures. Cash App has introduced advanced two-factor authentication and real-time fraud detection systems to help protect your financial data more effectively.

In addition to these improvements, users will benefit from new features that make managing finances easier. Enhanced budgeting tools allow for better tracking of spending habits, while a streamlined interface simplifies navigation through various services.

These updates reflect Cash App’s commitment to evolving with user needs and addressing concerns raised in recent feedback sessions. The platform aims to create a safer and more intuitive environment for all its users moving forward.

– Increased Transparency and Communication

Cash App is stepping up its game with a focus on transparency and communication. Users can expect clearer updates regarding account activity and changes in policies. This shift means more frequent notifications about transactions, ensuring you’re always informed.

The company plans to enhance customer support channels, too. A dedicated team will address user concerns promptly, making it easier for individuals to resolve issues without hassle.

Additionally, Cash App aims to create accessible resources like FAQs and tutorials directly within the app. This move empowers users by providing immediate answers at their fingertips.

With these improvements, Cash App is not just offering a payment service; it’s building trust through open dialogue with its community. Expect smoother interactions as you navigate your financial activities on this platform.

– Enhanced Security Measures

Enhanced security measures are a top priority for the Cash App following the recent settlement. Users can expect significant improvements in how their personal and financial information is protected.

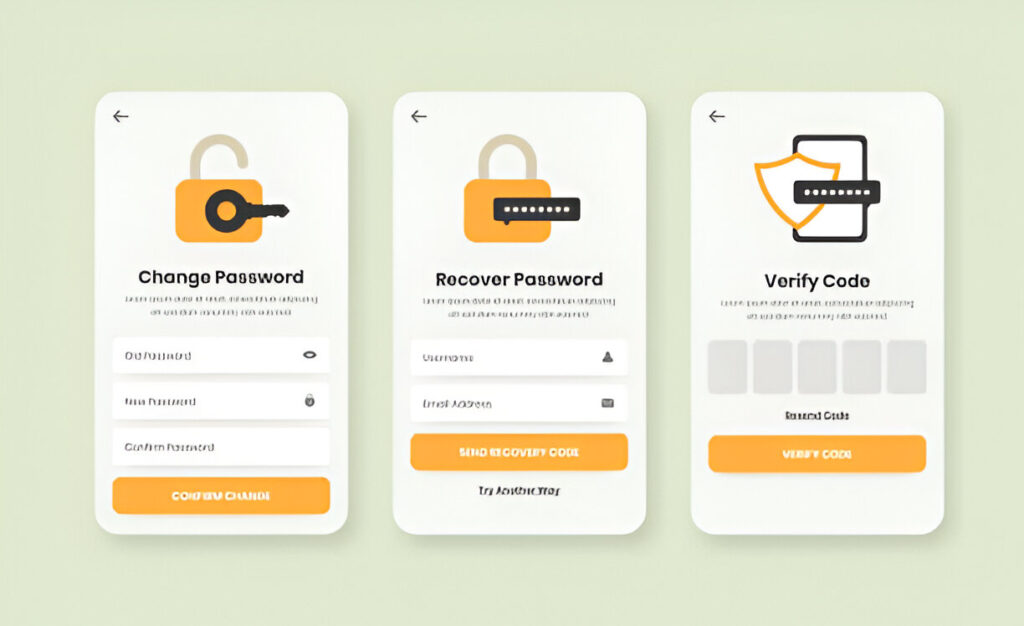

Two-factor authentication will now be more robust, requiring not just a password but also a verification code sent to your device. This additional step makes unauthorized access much harder.

Fraud detection systems are being upgraded, too. The app will utilize advanced algorithms that monitor transactions for suspicious activity in real time. If something seems off, users will receive instant alerts.

Moreover, Cash App plans to provide educational resources on avoiding scams and protecting accounts. These initiatives empower users with knowledge while enhancing overall safety.

With these changes, customers can feel more secure when using Cash App for their everyday transactions or sending money to friends and family.

– New Features and Services Offered by Cash App

Cash App has recently rolled out exciting new features designed to enhance user experience. One of the most anticipated updates is the introduction of Cash App Investing, allowing users to buy and sell stocks directly from the app. This makes investing accessible for everyone.

Another noteworthy addition is the ability to purchase Bitcoin through the Cash App seamlessly. Users can now dive into cryptocurrency without navigating multiple platforms, making it easier than ever.

The app also introduced a direct deposit feature, letting users receive their paychecks directly into their Cash App account. This offers convenience and speeds up access to funds.

Furthermore, Cash App has enhanced its social payment options by integrating more ways to split bills effortlessly with friends or family. With these updates, managing finances using Cash App becomes not only simpler but also more engaging for users looking for modern solutions in digital banking.

How Will This Affect You as a Cash App User?

As a Cash App user, I believe that the recent settlement brings several potential benefits that could enhance your experience. First and foremost, you can expect improved transparency. The app will likely communicate changes and updates more clearly, making it easier for you to understand policies and features.

Increased security measures are another crucial aspect of this settlement. With heightened protections in place, your personal information and transactions should feel safer than ever before.

New features may be on the horizon. These enhancements aim to streamline payments or offer additional services tailored to user needs.

To fully benefit from these changes, it’s wise to regularly check your account settings. Staying informed about security practices ensures that you’re maximizing what Cash App has to offer while keeping your data secure.

– Potential Benefits of the Settlement for Users

The Cash App settlement presents several potential benefits that users might find advantageous. First and foremost, increased transparency means you’ll have clearer insights into how your data is being used and protected. This can foster greater trust in the platform.

Additionally, enhanced security measures are set to safeguard user accounts more efficiently. With these improvements, transactions may become less vulnerable to fraud or unauthorized access.

Moreover, new features and services could simplify everyday transactions for users. Whether it’s faster payment processes or innovative budgeting tools, these updates aim to improve user experience significantly.

Lastly, this settlement signals a commitment from Cash App to prioritize customer satisfaction. Users should feel reassured knowing their concerns are being addressed with meaningful changes in place.

– Steps to Take to Ensure Your Account is Secure

Keeping your Cash App account secure is essential. Start by enabling two-factor authentication. This adds an extra layer of protection beyond just your password.

Regularly update your password and make it complex. Use a mix of letters, numbers, and special characters to enhance security. Avoid using easily guessable information like birthdays or names.

Monitor your transactions frequently. If you notice any unauthorized charges, report them immediately through the app’s support feature.

Be cautious with links and messages claiming to be from Cash App. Phishing attempts can lead to compromised accounts if you’re not careful.

Lastly, keep the app updated to benefit from the latest security features. Regular updates often include patches for vulnerabilities that could jeopardize your account’s safety.

Comparing Cash App to Other Payment Apps

When looking at payment apps, Cash App stands out for its simplicity and user-friendly interface. Users appreciate the ease of sending and receiving money instantly.

However, it’s worth comparing it to alternatives like Venmo and PayPal. Venmo focuses on social interactions with a feed that displays friends’ transactions. This can make payments feel more engaging but may not suit everyone.

On the other hand, PayPal offers extensive international services and robust buyer protections. It’s great for online shopping but might feel overwhelming due to its many features.

Cash App has unique offerings like Bitcoin trading and Cash Card perks, which attract a younger demographic interested in crypto investments. Still, some users find transaction limits restrictive compared to others.

Ultimately, each app has strengths tailored to different needs. Choosing the right one depends on individual preferences for functionality or security.

– Pros and Cons of Using Cash App

Cash Apps have become a popular choice for many users seeking quick and easy money transfers. One of its main advantages is the user-friendly interface, which makes sending and receiving funds straightforward. The app allows peer-to-peer transactions without needing cash or checks.

On the flip side, there are some drawbacks to consider. Cash App doesn’t offer as extensive customer support as traditional banks. Users may find it challenging to resolve issues promptly.

Additionally, while Cash App offers instant deposits, these come with fees that can add up over time. Security features are robust but not infallible; concerns about fraud persist among users.

Another appealing aspect is the ability to invest in stocks and Bitcoin directly through the app. However, this feature might not be suitable for everyone due to market volatility and the risks involved with investing.

– Alternatives to Consider

While Cash App has its strengths, it’s wise to explore other available payment options. Venmo is a popular choice among friends and family for easy money transfers, especially with its social feed feature that lets users share payments.

PayPal remains a heavyweight in the digital wallet space. Its extensive buyer protection policies make it ideal for online shopping and transactions.

For those seeking cryptocurrency capabilities, Coinbase Wallet allows users to buy, sell, and store various cryptocurrencies alongside traditional currency functions.

Zelle offers immediate bank-to-bank transfers without fees. It seamlessly integrates with many major banks, making it convenient for quick transactions.

Consider these alternatives based on your specific needs and preferences. Each platform comes with unique features designed to cater to different user experiences.

Is the Cash App Settlement a Positive Change for Users?

The recent Cash App settlement is a significant development for users. With increased transparency and improved communication, the platform seems committed to addressing user concerns. Enhanced security measures will likely provide users with greater peace of mind when making transactions.

New features and services can also elevate your experience, making financial management more straightforward than ever before. For many users, this could translate into tangible benefits—more control over their finances and an overall smoother app experience.

As you navigate these changes, ensuring your account’s security remains vital. Be proactive in protecting your information while enjoying the new updates that come with the settlement.

Cash App stands out among its competitors for its unique pros and cons. While it offers convenience and a user-friendly interface, exploring alternatives may be worthwhile if you’re seeking different features or fee structures.

Ultimately, whether this settlement leads to positive changes depends on how effectively Cash App implements these updates moving forward. Users should keep a close eye on developments as they unfold in 2024 and beyond.